Project Description

Financial technologies (FinTech) are expected to revolutionize the banking industry and help overcome inherent hurdles in the current finance-related processes (Krause, 2017). As an example, conventional trade finance processes (e.g., Letter of Credit) continue to be a resource-intensive operation due to the physical exchange and scrutiny of trade-related documents that are vulnerable to fraudulent activities (Varghese and Goyal, 2017). Bank settlements and fulfillment of financial obligations are also time-consuming locking up the working capital of banks and businesses alike (Hofmann et al., 2017). Moreover, the lack of transparency and interoperability between different networks of trade partners impedes the banks’ ability to detect anomalous and malicious behavior in the financial ecosystem (Piscini et al., 2017). The FinTech industry duly proclaims that the blockchain technology can address many of these inefficiencies (Guo and Liang, 2016). It is also expected to enable the creation of innovative financial services through the integration of data flows and processes across various stakeholders (ibid).

Realizing the legal and security challenges that this disruptive technology presents, the Central Bank of Qatar (QCB) in collaboration with Qatar Development Bank (QDB), recently assembled a FinTech taskforce to explore the full potential of Blockchain technology. The taskforce aims at creating a FinTech ecosystem to host start-ups and international FinTech companies to operate in Qatar under the umbrella of Qatar Financial Center Authority (QFCA). A blockchain sandbox will be established under the governance of the Central Bank to help companies experiment with FinTech utilities endorsed by stakeholders of the FinTech taskforce. The primary applications of interest include trade, payment, and commerce.

In line with the vision of the banking sector in Qatar and consistent with the call for research of Qatar’s National Priority Research Program, this Project supports the FinTech initiative in the following ways:

- Research, validate, and incorporate security and design improvements to the blockchain technology that will be chosen by the Central Bank and bring it to the next generation.

- Research and develop the smart contracts for FinTech and RegTech (technologies for compliance with regulations) utilities to facilitate trade for businesses in Qatar.

- Provide frameworks and novel processes that help optimize trade logistics thereby reducing ports congestions and shipping costs.

- Work with the Fintech taskforce to evaluate and align stakeholders’ expectations of the FinTech ecosystem with existing and future policies and regulations of government bodies in Qatar.

While the proposal is motivated by QNRF’s call for applied research on Cyber Resilient Fintech, we also address the current political challenges that are facing Qatar and propose effective means to alleviate the financial and operational hurdles facing the different trade stakeholders. Between November 2017 and August 2018, we embarked on a knowledge exploration initiative with local banks like QNB and QDB (represented in the FinTech taskforce), Qatar Financial Centre (that regulates part of the local financial industry), the Ministry of Transport and Communications (in charge of Custom’s Clearance Single Window and the Ministry of Foreign Affairs (handles the attestation of trade related documents like the certificate of origin and commercial invoice) to propose use-cases that create value for the different stakeholders. We also explored joint collaborations with potential partners like QPay (to incorporate an epayment settlement system as a supporting utility to trade finance), IBM (if Hyperledger was the product of choice), and SAP (to incorporate the Ariba business network with the proposed platform).

The key benefits that were identified within the banking sector include reduced processing time and cost, improved risk assessment, and diversified market opportunities. For local businesses, we expect the proposed solutions to shorten the trade cycle and improve liquidity. We also expect the novel Supply Chain Financing utilities to free the working capital, reduce shipping cost, and facilitate trade financing for SMEs. We expect the proposed solutions to result in operational efficiencies for the Customs Authority and Milaha Logistics and ease congestions at the seaport, reduce customs processing time and cost, and provide intelligence to predict fraudulent activities. Qatar’s Central Bank will have better visibility of trade activities through advanced AML and CFT analytics and reporting.

Sub-Projects

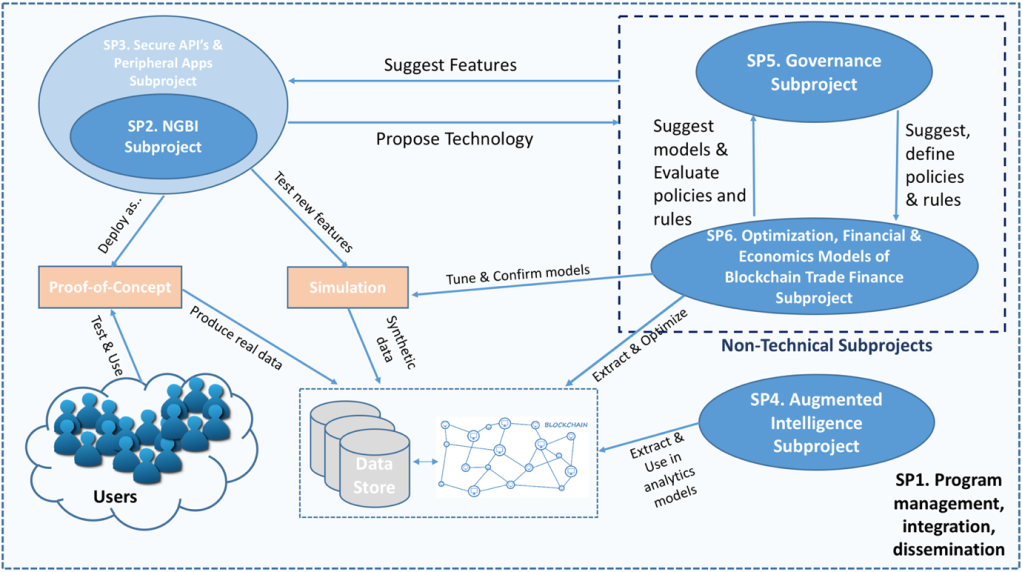

The project consists of six interrelated subprojects (SPs):

SP1: Project Management sub-project

This subproject is dedicated to the management and integration of the overall cluster. It is also responsible for managing dissemination activities and publication of academic works.

SP2: Blockchain Infrastructure sub-project

This subproject will develop the next-generation blockchain infrastructure with innovative features that are aligned with the basic requirements of business applications such as trade finance. While the developed blockchain infrastructure will be built to serve the trade finance application, its flexibility will ensure the fit for other business applications.

SP3: Blockchain Security sub-project

This sub-project is built on the output of SP2 by providing a set of secured APIs that will intermediate the calls between the peripheral business applications and the blockchain. For instance, a peripheral application can be a web application used by a bank to issue a letter of credit for an importer. The application will transact the letter’s data to the blockchain by calling standard web services. These web services will be served by the set of secured APIs produced by SP3 to ensure the eligibility of the web request and to filter out malicious requests (e.g. DDOS attacks and session hijacking). SP3 will also develop the peripheral applications used by the end users to streamline the trade finance process. SP2 and SP3 form the main technical basis of the cluster including several new features, in order to ensure that their functionalities are error-free, new features will be tested in a simulated environment and will be deployed in proof-of-concept applications from the earliest stages.

SP4: Augmented Intelligence sub-project

The usable synthetic from simulation or real anonymized data collected from end-users along with the conceptual applications will serve the fourth subproject (SP4). In fact, the generated data will be fed into the blockchain and its accompanying data store to ensure that the transaction data and the attached data are properly stored in the blockchain and the data store, respectively, and to train the AI modules developed in SP4. SP4 will mainly take care of developing advanced models for analyzing the data posted on the blockchain and its data store. SP4 will therefore continuously extract data and run analytics models on the transacted data for the sake of segmented intelligence. Augmented intelligence will serve different utilities usually used in trade finance such as credit scoring, identification of potential attempts for money laundering, terrorism financing and other malicious purposes.

SP5: Governance sub-project

This subproject will handle the governance issue of the newly proposed solution. Its main aim is to align the cluster’s activities with the Qatar FinTech taskforce and to suggest a new governance scheme that will ensure an optimal implementation of the technical solution in the Qatari context. The governance scheme will revisit the policies, laws and rules governing technology and trade finance processes. SP5 will maintain bi-directional interactions with the sixth subproject (SP6).

SP6: Resource Complementarity sub-project

This subproject will participate in suggesting new financial instruments and policies as well as evaluating the financial and economic feasibility of the suggested governance schemes before including them in the suggested final governance manual. The governance manual can then be forwarded to policy makers for discussion and potential institutionalization. In addition to suggesting new financial instruments such as supply chain finance and the evaluation of governance schemes, SP6 will exploit the transacted data on the blockchain and the data store to optimize trade operations and shipment. Optimization include demand aggregation and shipment bundling. Such optimization is believed to have a significant effect on decreasing trade costs.

The figure below shows the interrelationship and synergy between the different sub-projects.